If you work in the UAE or anywhere around the world; there are times when you face financial difficulties. You may need to find financial solutions quickly by getting a loan when this happens.

The good news is that getting a loan in the UEA is very easy now. By following simple processes with your bank, you will be able to get a loan in just a few days.

This article focuses on the essential details you need to know if you work in the UAE, have a monthly salary of AED2500, and would need a personal loan.

Important Things To Know

With a salary of 2500, getting a loan in the UAE may be a little challenging. This is because many banks and other lending institutions cap their lending on a monthly salary of AED 5000.

However, you can still get a personal loan from some of the lenders in the UAE, even with a 2500 monthly income. Here are important things to know before filling out that application for a loan.

High-Interest Rates

Because banks may not readily give you a loan with a 2500 salary, you may be forced to get a personal loan from private lenders.

Private lenders, even those registered to trade lawfully in the UAE, are known to charge hefty interest rates. The rates can sometimes be as high as twice what banks charge.

Lengthy Documentation Process

Since it may not be straightforward for banks to approve a loan with a salary of 2500 in the UAE, you may be exposed to a lengthy and highly detailed documentation process.

Besides, it may not be easy for you to fulfill the documentation required, such as loan approval forms. For this reason, if you wanted an urgent personal loan, it would be more advisable to explore private lenders.

Age Criteria

Personal loans in the UAE generally require that you attain a minimum age of 21 to qualify. The lender will need to confirm proof of your age by verifying your Emirates ID card or passport.

Also, you must not be older than 60 years if you are a UAE national or 65 years if an expatriate.

Good Credit Score

Creditworthiness is one key measure banks use to determine whether you qualify for a personal loan in the UAE or not.

With a bad credit score, there are higher chances that your loan application will not be approved.

Emirates Status

Many lenders recommend that the current employer must have employed you for the past one to six months. More years of employment will increase your chances of qualifying for the loan.

Listed Company

Banks generally list particular companies in the UAE to make it easier for their employees to get loans. This is likely to increase your chances of qualifying for a loan with a 2500 salary.

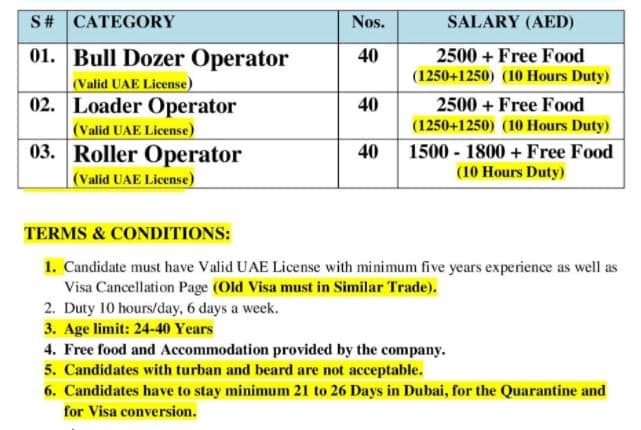

Minimum Salary

Generally, banks require a minimum salary of AED 3000 or more. However, you can get a First Abu Dhabi Bank Revolving Overdraft facility with a minimum wage of AED 2000.

It is, however, not easy to get a personal loan with a monthly salary of AED 2500 in the UAE.

Documents Required

Just like with other personal loans in the UAE, to apply for a personal loan with a 2500 salary UAE, you will need to avail of the following documents:

- Salary certificate

- Emirates ID for nationals

- Salary transfer letter, where applicable

- Bank account statement

- Trade license for business people

- A valid passport for expats

- Residence visa for expats

- Loan application form

Advantages Of Personal Loans In UAE 2500 Salary

- Getting a personal loan will help you meet personal expenses while working in the UAE. Some situations where you may need a personal loan include business investment and fulfilling emergency expenses such as paying hospital bills.

- A personal loan can help you maintain stability in a company, as required by many lenders.

- A personal loan with a 2500 salary can help you maintain a good credit score. A good credit score is required to qualify for bigger loans with financial institutions.

Types Of Personal Loans In the UAE

Some of the personal loans you can get in the UAE with a 2500 salary include the personal loan for expatriates, loans without company listing, loans for nationals, loans for self-employed professionals, and loans requiring salary transfer.

The different loan categories require various documentation, and lenders follow different qualification criteria.

Banks Offering Loans

It is nearly impossible to get a loan with an income less than AED 3000 in the UAE. Therefore, you may not get any banks willing to offer a personal loan with that salary. However, you can try the First Abu Dhabi Bank (FAB) Lifeline